Not every construction business is created equal. That’s one reason in the proliferation of construction software for field productivity and other important IRONPROS construction technology categories will fragment over time. An excavating contractor will have markedly different requirements for any number of software tools than a midsized general engaged in light commercial and office space. Modern software-as-a-service (SaaS) software puts robust and highly performant business technology within reach of middle market and smaller contractors, and enterprising vendors are pursuing segments of the market with optimized products.

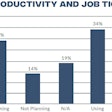

That makes sense given that field productivity software was the number one field technology among 2023 State of the Industry: Construction Technology Report.

Software from major enterprise vendors may be configurable to deliver the process flows in different construction contracting businesses. But construction software verticalization is important because it lowers the barriers to entry with less cost and complexity by bundling in appropriate workflows for specific types of contracting environments.

FieldFlō is one of a number of field productivity software vendors aiming for underserved parts of the market, and diversifying the functionality to address more of these contractors’ needs than many competing solutions.

Construction Software for the Field

Field productivity software—the link between core construction business processes and the field—is verticalizing. While these solutions share a focus on job and materials ticketing, different emerging and entrenched products are targeting specific parts of the market. And some of them are evolving to address not just crews on construction sites for a day or more, but field service management for crews or technicians visiting multiple sites per day.

Raken, for instance, focuses on general contractors with a sweet spot between 11 and 200 employees.

“We serve generals from five or six to 5,000 employees,” Raken Senior Solution Sales Manager Brian Poage said. “Our sweet spot is 11-200 employees.”

Poage said the company had focused recently on enterprise agreements with the top ENR contractors, including subcontractors doing electrical, mechanical, concrete and excavation.

Assignar, meanwhile, targets horizontal contractors with from $10 million in revenue on up. Self-performing divisions of multi-billion-dollar contractors worldwide—including the likes of Laing O’Rourke—are customers. But the sweet spot for Assignar is between $10 million and $250 million in revenue. The other factor that makes contractors a great fit for Assignar is the amount of equipment they own. The more heavy equipment, the better the fit due to robust equipment scheduling features. Field operations offerings from HCSS and B2W will also be strong options for heavy, civil contractors using these application suites.

Sage Field Operations, an independent software vendor (ISV) solution for Sage construction ERP products from Operix, adds a new wrinkle to the field productivity equation—it includes functionality for field service management.

Specialty contractors would often need both sides of what Operix is offering here—construction software to manage delivery of production in the field and then field service management software to let a mechanical contractor, for instance, profitably deliver on annual maintenance contracts. A contractor can assign work packages for a project to a crew assigned to deliver production on site, capture labor hours, specify forms to be used for other reporting, satisfy requests for information and create daily field reports.

Sage Field Operations also provides a middle ground between service and construction, enabling a contractor to set up a small job with a simplified budget so they can still track actual cost against a scope that may even be completed start to finish on the same day. This scales gracefully up to the full construction project finance capabilities of progress billing and capitalization of expenses and work-in-process accounting from the underlying Intacct accounting package if a work order takes long enough to complete to make it desirable.

The move towards a unified approach to field productivity and field service management is working both ways … field service management stalwart Service Titan has also added functionality enabling the software to facilitate projects as well as service.

Coming from Demolition Contracting

In an August 2023 discovery call, FieldFlō CEO and Founder Roni Szigeti and FieldFlō Vice President of Growth Brittany Szigeti laid out their field productivity software offering’s vertical focus and other differentiators.

Roni Szigeti brought to the organization a background with demolition and environmental contracting. The diverse needs of these contracting environments are reflected in the functional set of FieldFlō, which gives self-performing contractors and trades to facilitate time tracking, crew tracking, safety documentation, permitting, certification tracking, skill tracking, warehouse/inventory management, closeout reporting and project tracking.

“The low-hanging fruit is our ability to give them time tracking capabilities,” Roni Szigeti said. “Crew tracking is really what we talk about. The second thing is safety and regulatory compliance. So we cover everything from safety reports, inspections, and other needs through custom form buildings. Our customers can create theoretically any form that you would ever need for their business type or their specific business. From there, we go job costing, inventory, scheduling, training, and certification tracking. Those are the big bolt-ons that I would say are used by 70% to 80% of our clients.”

FieldFlō rides into may net new contracting customers through the Sage partner network, benefiting from a far—flung team of value added resellers (VARs) who can bring them into new deals and established customers on Sage 100 Contractor, Sage 300 Construction and Real Estate and Sage Intacct Construction. Other standard integrations include Quickbooks Enterprise, Coins, Acumatica and Trimble Viewpoint Vista.

Once a new customer is in the door, Roni Szigeti said the organization takes a high-touch approach to onboarding.

“Every single client that we have, no matter what you're spending, gets assigned to an account manager,” Roni Szigeti said. “So you have someone that's dedicated to your account. The beautiful thing with FieldFlō is ease of use. Our inside joke is that we're going be your best friends for the first two to four weeks, and then you're going to forget about us. Fortunately, we built a very intuitive software, so the onboarding is a lot of fun. We're definitely hand-holding them and giving white gloving that support up front. After that, they just cruise and need very limited support. Most of the calls we get are like, “Wow, this is so cool.”

FieldFlō functions largely as a conduit for information from the back office and the field, assigning tasks to workers and crews and enabling site-based personnel to report on progress.

“We have job costing built into FieldFlō,” Roni Szigeti said. “So you have real time visibility in FieldFlō because we're the point source of data capture. So we pull the workflow out of ERP, or they can set it up in FieldFlō if they're not on intelligent ERP. So you set your budgets, write your estimates, and then FieldFlō tracks against those jobs and budgets to give the project manager or the superintendent real time job costing. And so kind of real get really given back that feedback, also the production tracking. And again, you can theoretically build any type of form to pull data and analytics out of the projects that are being completed. We have a very robust API, so we flow that data back to the ERPs as well.”

Individual users can configure notifications to alert them abreast of specific project details, and Roni Szigeti said there were at least 30 notification types preconfigured.

Once production work is completed, relevant data points are ported back into a contractor’s ERP software.

“If they are using pen and paper as ERP, then in FieldFlō, they would actually set it up to send that data to themselves,” Roni Szigeti said. “And they can set up labor, inventory and equipment. If they're an excavation company, or civil or even a demolition company, they can set up wastes or load counts estimates. They can set up budgets for subcontractors as well.”

Data is entered into FieldFlō using the flexible forms feature, with the ability to make some forms mandatory for certain users and projects. And the software does double duty between field productivity and field service management for contractors that need that flexibility with regard to both scheduling and production reporting.

“In FieldFlō, the schedule is also talking to the timesheet as well,” Roni Szigeti said. “You can see their production, you can see where they're at. But also, you can check to see if they have the right certifications to be on those job sites. Everything is working in tandem, flowing between departments of a company.”

The product has fairly robust inventory management capabilities including multi-bin locations and the ability to track inventory on service vans, which essentially become mobile warehouses.

FieldFlō Tech Stack

FieldFlō is a multi-tenant software-as-a-service (SaaS) application residing on United States-based compute capacity on Amazon Web Services. The product relies on an AWS-based stack including the Linux operating system, the Apache database server, MySQL database server and the PHP programming language.

The development team ships new product every two weeks, with major releases with significant new features coming each quarter. Bug fixes and security patches are shipped on an ongoing basis, with all product being subjected to appropriate penetration testing.

FieldFlō Pricing and Market

FieldFlō will become viable for contractors with between $2 million and $ 20 million in annual revenue. The architecture of the product is not a limiting factor that prevents FieldFlō from going up market—multi-office features have helped the company scale up to contractors with $2 billion in revenue and offices into the double digits.

The software was initially marketed heavily to demolition and environmental contractors, but as is the case with other emerging construction software products, the Szigetis have added more and more construction disciplines to the list of addressable markets, including civil contractors and excavation companies.

“Now we're getting a ton of steel fabricators and installers” Roni Szigeti said. “If you care about your self-performed work, care about time, care about safety and care about production, it could be a good fit for you.”

Pricing is based on tiers based on the number of users, with the number revisited annually.

According to Brittany Szigeti, the entry level price point for FieldFlō is $10,000 per year, which is what the smallest subcontractors using the product are paying.

BOTTOM LINE: Construction software has come to the field, thanks to cloud, mobile technology and agile architectures that enable a small contractor to stand up a robust solution. The two camps of field productivity for project-driven work and field service management software for multiple stops a day by a technician or crew are coming together in the middle. In FieldFlō, contractors get a tool aimed at different types of trade contractors than other emerging products, and performant integrations with major construction ERP players. More integrations and more capabilities are on the Szigeti’s roadmap, and we will follow them here on IRONPROS.