Mobile computing with geolocation is central to a number of construction software technology categories, including field productivity software to encompass the work-in-progress portion of a construction project in a digital workflow.

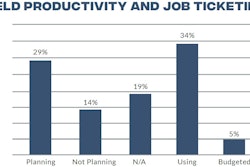

Field productivity software was the most commonly-adopted construction field technology in the 2023 State of the Industry: Construction Technology Report, besting other popular technologies like GPS asset management software, safety technologies, digital site survey hardware, photogrammetry and computerized maintenance management systems (CMMS).

Field productivity software provides efficient digital workflows for field-based processes other construction software—including project management tools—are a miss for. So assigning work packages to crews or individual workers, assigning equipment to projects and tasks and recording tasks as they are executed are all processes field productivity tools deliver. In some cases, field productivity software will assign work to and capture production data from machines in the field, but more universally it encompasses people-focused activities, including time clock tools, attachment of photos to document site conditions and more.

Photo attachments are a popular feature of field productivity software, enabling someone on site to document work completed, challenging site conditions or nonconformances. But photogrammetry software leader OpenSpace, which makes its bones on 360-degree images stitched into progress reporting, is evolving in ways that will make it more usable in the field as well. A new BIM Compare feature enables workers in the field to compare a BIM model side-by-side with actual site conditions. Customizable tags, meanwhile, could soon enable a construction team to configure the product more aggressively to track activity or productivity in ways that could bump heads with designated field productivity solutions.

But PLOT, the Wichita-Kan. startup, rather than expanding towards an existing function of field productivity software, brings an entirely new capability to the field. The product may walk a line between supply chain management and field productivity. While another emerging construction software category focused on procurement address a number of supply chain management challenges contractors face, once materials, parts or consumables get to a site, all bets are off. A construction site may have its own address, but the specific location deliveries need to go on site, the route to be taken to get there and other information may fall between the cracks, causing delays, confusion and non-value-added work for contractors. PLOT streamlines management of site deliveries, jobsite movement and material lead times.

In June of this year, the company nailed down $2 million in a second seed round, bringing its total raise to date to $3 million. Since then, CEO Chris Callen has been on a hiring spree, bringing on sales and customer support talent with tenures at construction technology companies including Matterport, Eyrus, Structionsite and others. Announced with the funding round was a new lead time management module, so contractors can more easily track materials through approval, ordering and shipping. This tool flows directly into PLOT’s delivery module, which has already been in the market and adopted by a growing customer base.

Construction Site Logistics Software

The IRONPROS category for supply chain and logistics software is dominated mostly by companies like Kojo that are focused on spend management. In a briefing with IRONPROS, Callen acknowledged the PLOT product may have one foot in supply chain management, but does not deal with demand or procurement. PLOT addresses processes that are still dealt with in an ad hoc fashion in Excel. PLOT encompasses:

- Deliveries to project sites, including requested delivery windows, detailed directions within the site and automated updates to the supplier if delivery time or location have changed

- Exposure of site details to suppliers including navigation to or within the site, weather at the project location and more, all shareable with a QR code or link

- Crew coordination through tools for inter-company collaboration, and for limited users, jobsite alerts across a number of platforms

New functionality from PLOT will expand the size of its addressable market, according to Callen.

“So far, the logistics and our deliveries modules have really targeted constrained or significant scale sites—basically, either a large footprint job site where navigation to a specific gate or dock or loading area is a problem, or a constrained site,” Callen said. “These are typically an urban environment, are going vertical and have one lane of traffic to unload every truck that comes to the site. So far with our lead time module, we still look at those projects as our target, but we want to expand our project target pool to majority of projects out there with a subcontractor environment. Contractors ordering material should find value in our new lead time module, so it is really opening it up, not only to different types of projects, but also looking to go down market to smaller, mid-sized projects, not just the mega ones.”

On both the delivery and lead time fronts, this could distinguish PLOT from other offerings, making it a bit of a category buster. It is these emerging offerings though that help eliminate shadow IT like disconnected spreadsheets around the organization where they stubbornly cling to unaddressed problems.

“We've seen some other softwares that are focusing on the sourcing and payment and kind of the financial side of procurement,” Callen said. “We're really not doing that. We're integrating with the submittal libraries, and then connecting through material lead times to the delivery, which is most often associated with an activity on the CPM (critical path method) schedule. Most of the general contractors that are alpha and beta testing with our new lead time module had been using Excel spreadsheets, and those spreadsheets are all fairly similar. But they are all unique to not only the contractor, but they're unique to the individual project team itself.”

Eliminating Spreadsheets in Construction Logistics

Notching out Excel is one more way not only to gain visibility and control across the business, while eliminating expensive non-value-added work.

“With Excel, the best-case scenario is you have someone dedicating a large portion of their day to check on submittal status to go in and see where the design team is on things,” Callen said. “And then you have this spreadsheet that primarily serves as the basis for a dedicated meeting or a dedicated portion of a meeting where all the subs are in the room. The GC is walking through this procurement log, and they're talking about one item after the other. It's very, very manual and arduous. The worst-case scenario is you have misses, or maybe even worse than that would actually be incorrect data without any sort of cleaning, relying on formulas.”

These lapses can slip through gaping holes in other digital workflows.

“The procurement section in the CPM schedule tracks usually the top 10 or top 15 pieces of equipment to be procured and installed,” Callen said. “But other than that, most everything delivered to a job site is either not tracked, or they're tracked in a spreadsheet environment.”

PLOT Tech Stack

PLOT is provisioned on Amazon Web Services (AWS), relying on several Lambda functions which helps keep costs low as the compute resource scales in real time with usage with no delay in availability. The application is built in React with Ruby on Rails, with the PostgreSQL database.

The product handles logistics mapping starting with a PDF site plan or a satellite image inside of a PDF editor. Using this document, PLOT creates a hosted website, including a publicly-accessible profile for the job site. A general contractor can direct project collaborators to that site, or create a PDF output that will have a QR code pointing back to the site.

“That profile’s primary function is navigation to and within the job site,” Callen said. “How do I get to this specific gate? And how do I get to this dock. This is very specific information that addresses either are not accurate for or they're not detailed enough. Another consideration is delivery management. Think of this as the way a corporate office might manage their conference rooms by having the ability to book and reserve them. Similarly, subcontractors can reserve a loading area, a skip hoist, or the elevator or tower crane. They can basically reserve time for their delivery to arrive on the job site and then move vertically so that they're unencumbered and their truck gets in and out and as quickly as possible.”

PLOT is accessed most broadly in TV Mode, enabled by a FireTV stick plugged into a monitor in a job trailer. The screen displays the site QR code, so a foreman can scan it and book a delivery. Once the delivery is booked, it appears on the left-hand side of the screen, in context with all the other subcontractor deliveries.

This TV Mode, according to Callen, is about more than imparting information in the software. It also engages the wetware through a little human engineering.

“In that TV Mode environment, we're competing with a whiteboard—that’s really the analog process,” Callen said. “Being able to see your handwriting on the whiteboard—that’s the psychology of that. It’s a commitment. There is the psychology of seeing everyone else up there, because you're participating in a larger group.”

PLOT Pricing and Market

Like many construction software startups, PLOT entered the market with enterprise-size contractors with large and complex projects and also the bandwidth to adopt new technologies.

While PLOT has earned its street cred in large contractors and large projects, Callen said that with the addition of the lead time module, the software will be a fit for any project over $50 million. This puts a contractor with revenue of at least $100 million or so in the PLOT wheelhouse. PLOT will be a fit for even the largest projects, but Callen said that as a collaboration tool, it may not be right for some sensitive sites where information about site operations must be guarded rather than shared openly.

“The entire point of our platform is to make data accessible easily to the project team,” Callen said. “For job sites where accessibility is trumped by security, we probably won't do well there.”

PLOT faces only scattered competition. Different products from different vendors handle portions of the PLOT complement of processes, and then not in a fashion designed to extend that data across the project team when and as needed. LeadTime may bump up against the new PLOT module, Bluebeam may compete for logistics mapping or Voyage Control Site Logistics on delivery management.

The growing PLOT management team was at the time of the debriefing working on a new pricing model, which Callen said would be in place by the end of 2023. The software has to date been sold on a per-month, per-project structure, with enterprise pricing for a larger number of projects bringing a discount, starting at about five projects.

The new pricing according to Callen will likely focus on making PLOT a viable option for more small projects.

“We believe value should be in line with the price, Callen said. “And then obviously, a tool like ours is more valuable, the larger the project is. So we want to make sure it's something fair to all different types of projects so that we don't we don't miss out on the opportunities down market.”

BOTTOM LINE: PLOT appears to have proven itself in the field as the solution to problems so common on construction sites and projects that they may have been assumed to be intractable. Apart from driving towards wider market adoption, PLOT will be working to build out additional integrations beyond an existing one with Procore. But the application seems to be designed to drive value on-site and among vendors interacting with the site location or inventories, even without extending it with other solutions and the value is easily realized. That value will magnify itself given the complexity of a large project and demanding site. But for middle-market contractors who want to seize control of site logistics, more flexible pricing and the new lead time module make PLOT worth a look.