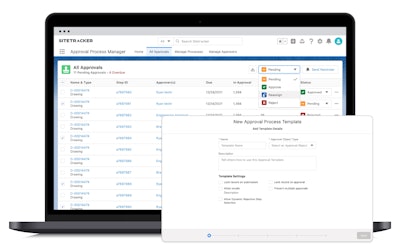

One underappreciated way contractors can get their hands on advanced cloud construction software is to buy from independent software vendors (ISVs) of the technology giants. These companies extend platforms like Salesforce, Microsoft Dynamics 365, Netsuite, Oracle Cloud ERP, SAP or other products to meet the needs of specific industries.

That is exactly what Montclair-N.J.-based Sitetracker is doing, creating a solution with substantial enterprise functionality for utilities contractors on top of the Salesforce platform. Sitetracker is a full business lifecycle solution specific to the needs of telecom deployment and operations and alternative energy contractors. Telecom outside plant contractors are bracing for growth driven by the $48 billion Broadband Access and Employment Program’s (BEAD) Notice of Funding Opportunity (NOFO). Renewables contractors are facing a similar delta, with wind turbine and service technicians and solar photovoltaic installers the two fastest-growing professions. Some forecasters suggest non-hydro renewable electric capacity could grow by almost 200% in the next 10 years.

Sitetracker is growing by about 30 percent per year ARR, currently employing about 350, including between 40 and 50 people focused on customer support. Apart from this internal team, Sitetracker can bring in implementation help from major consulting firms through partnerships, including Cap Gemini or Tata Consulting.

“We are in a hot market,” Sitetracker Director of Industry Products Brant Carter said in an April 2023 discovery call. “Generally speaking, there are a ton of tail winds driving our growth. We have a lot of tailwinds to our business. One of them is 5G. Every single cell tower in the world needs to be touched to install a 5G or radio on it. Our software facilitates all the work.”

Construction Software for Repeatable Projects

The software facilitates the work, but also the business. Functionality spans finance and revenue management, site/asset management and milestone-based project management.

“Too many of these project managers have specialized Excel spreadsheet,” Carter said. “It is hard —hard to take that Excel spreadsheet and operationalize it to get more leverage and best practices and scale the business.”

Sitetracker encapsulates the business cycle front-to-back, eliminating a lot of shadow IT that will keep data siloed.

“Our core product focus is high volume repeatable construction,” Carter said. “We are automating an order-to-cash process. It is a straight-through value stream so you cannot layer on too much process--just the amount of process required to have efficiencies.”

Some telecom and renewable contractors see a lot of value pile up in the application for payment process, and Sitetracker addresses this with a rigorous workflow.

“Our customers have to produce closeout documentation to get paid, Carter said. “If pictures are blurry or if you missed something they will look for every excuse to not pay you. Then, you need to get a dispatch crew out to take more photos. That means you use up all your margin by not having that closeout done.”

By delivering a streamlined workflow for from contract to cash, Sitetracker can help contractors waste less and produce more.

“A lot of our customers can drive their margin up a few points,” Carter said. “That means they can buy up smaller contractors and put their playbook on top of them. They can take that Sitetracker IP and scale it.”

As an ISV, Sitetracker can extend a powerful enterprise backbone with very specific functionality.

“If our customer is working on a cell tower—when you create that project in the software, you can geofence around the cell tower,” Carter said. “Crews check in automatically. When they take closeout photos, the software automatically geostamp the photos. When you are decommissioning a cell tower, or working on hundreds or thousands of small projects all over, you have milestones to track, and need to track material, the transaction of replacing a 2G with 5G antennae. The contractor may also have to provide a condition assessment on the tower itself, making sure anchor bolts are tightened.”

There are even provisions in Sitetracker for reverse logistics, so as hardware is removed from the field a contractor has a workflow for how to take that part back into inventory. Once the material is returned from the field, a contractor may however still want an external materials management system to track part ownership and whether it can be re-used. Inventory is challenging in general for telecom vendors working on fiber optic extensions because the contractor will generally not purchase the materials. The cable is typically purchased and owned by the telecom, and it is simply stored at the contractor’s site. Tracking ownership and pegging materials to specific customers or projects is therefore crucial, and Sitetracker delivers.

Sitetracker Pricing and Market

Contractors involved in fiber optic cabling, telecom, renewable energy, electric vehicle charging and other disciplines may find Sitetracker a fit.

“On the tower side, we sell to the tower companies,” Carter said. “Apart from operations, we help them with passive infrastructure use, consolidating and creating new tenant opportunities on their towers. Verizon for instance has sold off towers and has multiple tenants on each one, co-located. The electric vehicle charging market is a fit, and we are probably the market leader in supporting those projects right now.”

While utilities often involve linear assets, Sitetracker does not work right now with road builders. But customers do include some of the largest market players including Lumen Technologies, Frontier Communications, Sparklight, Cox Communications and Comcast.

“Smaller contractors that might have eight or nine crews start to be a fit,” Carter said. “If you have three guys and a truck, we probably don’t have a product that will offer a lot of ROI immediately to you.”

Sitetracker sells on a per-user named user basis with pooled licensing for subcontractors and collaborators.

“In general, there would be some internal back-office staff, and they would be one pool of users,” Carter said. “The field users are another pool and each of those have a specific price point.”

BOTTOM LINE: ISVs that extend the larger enterprise technology infrastructures for construction should be seriously considered by utility and other contractors that need to digitize their business. Sitetracker, using this model, has paired tightly focused functionality for utilities contractors with the benefits of a world-class digital backbone. This middle-market-sized ISV does not need to re-invent SaaS software on its own—it has Salesforce for that. That means they can focus their research and development resources on meeting the needs of their target market.