Based in Columbia, Mo., EquipmentShare is kind of the progenitor for many other venture-backed, multi-tenant software-as-a-service (SaaS) products coming to market in the construction industry. Founded in 2014, it is older and more mature than many other vendors in the space, many of which are less than five years old. And through the venture capital firm Scale, EquipmentShare CEO Willy Schlacks has backed other construction software startups like CostCertified, insurance tracker HoundDog and mortgage lending platform CharlieMike.

Digital transformation for construction

Like other companies Schlacks has a stake in, EquipmentShare aims for more than digitization—taking existing processes and moving them from analog to digital systems. Rather, the goal is to leverage technology to enable business processes and value creation in ways that were not possible without the transformational tech we now take for granted—tech like the internet of things (IoT), artificial intelligence, mobility and cloud.

The company has put these technologies onto the problem of equipment rental, getting a jump start by winning the 2014 Startup Weekend Columbia competition for their idea of a peer-to-peer marketplace where contractors could rent equipment from other contractors. What this required though was the creation of a nationwide equipment distribution network and hooks into telematics that captured utilization data from every machine in the network. They wanted to change the way contractors manage their assets, people and materials, and to do that, they had to think bigger.

That bigger vision came to fruition in the form of a construction business software applications that underpins EquipmentShare’s rental functions, but has since been extended to address other operational areas of a construction business. Launched in 2021, T3 is billed as an operating system for construction, and expands EquipmentShare’s remit beyond equipment management of rental and owned equipment to broader management of assets, people and materials in a construction setting. The application ingests equipment telematics data, data from its own timecard application, mobile expense capture and inventory modules. Apps in the T3 suite include:

Fleet—OEM-agnostic telematics

Time Tracking—Schedule management, labor time card capturing, work order management and more

E-Logs—Electronic Logging Device compliance with digital reporting

Analytics—Customizable reports on utilization, job cost and more

Work Orders—For equipment maintenance

CRM—Track vendors and customers

The product is growing in scope rapidly, and newer functionality encompasses:

Cost Capture—Record expenses from a mobile device along with invoices for full expense management

Inventory—Plan inventory consumption across jobs with a streamlined intake and parts order workflow

Rent Ops—Manage assets on projects with external and internal rental functionality

EquipmentShare has made extensive investments in becoming a leading provider of rental equipment—acquiring equipment rentals and dealerships to create a virtual, digital-first rental platform. You may think they would primarily work the back door of that customer base to sell T3, which seems well-suited to equipment-intensive contractors. And according to EquipmentShare Director of Product Angela Page, because T3 underpins the EquipmentShare rental experience, customers can easily add functionality from the application suite to extend the solution they are already relying on deeper into their contracting business as a broad resource management solution. But there is also dedicated team of sales reps specifically for T3—a couple dozen strong at the time of our June 2022 debriefing. The team of employees focused on customer success—ensuring customers get the onboarding, training and support with T3 to be successful, was also about two dozen at the time of our call. Existing customers are assigned their own customer success manager based on their region, which would help EquipmentShare develop deep rapport with that customer base and help them grow together over a period of years. The regional strategy makes it easier for these customer success managers to work with a customer on-site, but most onboarding can be done virtually, according to Page.

What this means is that EquipmentShare, with a growing sales force and dedicated customer success team, has the capacity to grow its customer base. A T3 product team of about 150 is also growing, a pattern that suggests continuing home-grown functionality is coming to attract new adherents while growing the solution footprint inside of its current installed base of contractors.

EquipmentShare big picture

In our debriefing, EquipmentShare CEO William Schlacks, the company sees a future well beyond its current footprint. Like other companies leveraging real-time telematics information from equipment like Trackunit, seeks to address systemic, industry-wide issues rather than just facilitating existing business processes.

“Our initiatives align with what the major macro vision is—the big problems faced by contractors,” Schlacks said. “There has been no platform that creates visibility into the job site, and by extension of that, people, equipment and materials. Our next steps will involve our getting more heavily involved in inventory. Inventory visibility probably does not exist in any industry yet, but is completely disconnected from operations in the construction industry. Visibility is all about enabling status information through workflows, and one of the primary workflows is actually rental. Most see telematics and GPS as the answer, and it’s not. It is just a single data point. Assignment of that equipment, answering the question of is its availability—is it on rent to a job site? What is the health of the asset? Is it broken down?”

EquipmentShare T3 provides this visibility with regard to equipment, and also with regard to people with its time clock app. T3 Time Cards provides visibility into the hours employees work against projects, with straightforward integration options for payroll and enterprise resource planning (ERP) software. The software provides a mobile app for recording time and an analytical/management web interface supervisors can use to approve employee time cards. EquipmentShare’s next step for the platform is go deeper into another source of construction cost—materials.

“Our next steps in this product will take us much deeper into inventory management, which in construction is usually completely separate,” Schlacks said. “We do have a pretty robust warehouse management system (WMS) … This workflow will start at the purchasing or creation of things. Purchase orders, budgeting, products buying, receiving, and the transaction to show that this is now a physical good which is associated to the product and purchase along with related attributes once it is received at an inventory location. It can be consumed, sold or rented.”

But inbound inventory transactions are not the limit of where EquipmentShare is going. Designated equipment rental companies are not the only ones that need software to facilitate transactions for equipment rental. Contractors with large fleets may also rent out equipment to increase utilization rates.

“We have a number of large companies piloting outrental,” Page said. “The primary initial need was to handle rental to internal subsidiaries. As they wrap their organization around the requirement of formalizing these processes, they need to make that transition to treating equipment as something they can rent out. They are still using ERP for invoicing, and T3 automates all of that for them. The first step is enabling the company to answer that question—what is available. Then they can determine if they have capacity in their fleet for outrental.”

This feature is being piloted now, but according to Page will likely see a more formal release to market in the fourth quarter of 2022.

Equipmentshare tech stack

EquipmentShare T3 is a multi-tenant software-as-a-service (SaaS) application provisioned on Amazon Web Services (AWS). The T3 application makes heavy use of the React open-source front-end JavaScript library. The transactional layers are built on a service-oriented architecture (SOA) consisting of multiple application programming interface (API) layers. These APIs are used to route processes and transactions internal to the software and also can be opened up to external software and technology for inbound, outbound or bidirectional integrations.

Given the company’s roots on the equipment side, EquipmentShare takes equipment telematics very seriously.

“On the telematics side, we have quite a bit going on,” Schlacks said. “We own the tech stack to the bare board, and build our own hardware in many cases,” Schlacks said. “We have some tech stack on the hardware that runs pretty standard robotics and can range from services that connect to OEMs like Cat, and Deere to hardware we build and have embedded on the factory floor. We also support fairly distributed systems from Bluetooth nodes to slap trackers onto smaller pieces of equipment on up to advanced autonomous devices.”

This ability to harvest data from a diversity of device types means even Bluetooth Low Energy (BLE) signals on hand tools can be captured, making that element of inventory and job readiness part of an overall view of the company.

“There are a lot of BLE chips,” Schlacks said. “We primarily we see Dewalt and Milwaukee Tools. T3 consumes that data automatically. We have industrial clients that leverage that on a big oil refinery, for instance. There is not a lot of value to some of that data–some are putting in battery life or run time in there—nobody cares. The user of that tool knows far better when they need to care about the battery life. Maybe next iteration of Bluetooth 5.0 will be better, and maybe ultra-wideband (UWB) will be better when that becomes more broadly supported.”

Market and pricing

With the built-in prospect base of EquipmentShare rental customers, T3 has a leg up in terms of building a customer base.

“Any of the software rentals come with our technology embedded on it, and it is a low-risk way

We have elements of T3 that are geared towards rental, and that gives us a differentiator from different equipment rental providers and also lets them see what they could to with tracking their own fleet or perhaps other things the product addresses.”

While T3 is expanding EquipmentShare’s remit beyond rental or even beyond equipment management, having a substantial amount of equipment in a fleet is still a primary determining factor of who will be a fit for this product.

“The best fit contractors that can get the most out of T3 include mid-sized to enterprise-size contractors who need to manage assets and are at that point where they can’t just run around in their truck and look after everything,” Schlacks said. “As soon as it gets to that point, T3 becomes a good tool. Some of our customers have one to two pieces of equipment and trucks and then also use our time cards for their employees and other management tools. But generally, we see contractors with 50 to thousands of machines.

In terms of revenue, EquipmentShare may start to become viable for a contractor with as little as $5 million in revenue, and then scale up to the very largest international, engineer procure construct (EPC), enterprise-level contractors.

“On the dirt side, they own the majority of their assets, Schlacks said. “Other contractors that build the envelope rent most of their equipment,” Schlacks said. “The same goes for contractors building refineries or energy projects. Regardless, they can use T3 to manage all of the variables required to deliver projects on a single pane of glass.”

These customers pay for T3 based on through one-time hardware costs, and then on subscription by device type being tracked, data feeds that need to be set up and the number of devices connected, ranging from Bluetooth devices to, camera arrays and telematics devices. This monthly subscription does not charge by the module yet, in part to encourage adoption among and grow their footprint, but per-module pricing will be coming. Hardware sold by EquipmentShare can be installed by the customer, but EquipmentShare also has one of the largest install fleets in the country.

Under most circumstances, customers can be up and running and realizing value quickly.

“A lot of the cost depends on what type of trackers they need for heavy or light equipment or light tools,” Schlacks said. “We do install and ship hardware—that can take a week to two. We then let them run for a day before we schedule the onboarding so there is data in the system.”

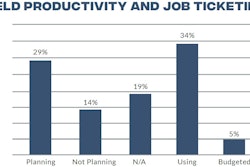

BOTTOM LINE: EquipmentShare is ambitious in its vision for connected construction application that unites people, equipment and inventory. And thanks to an early start relative to many other construction technology startups is further down the road to realizing that vision than most of the market. The T3 product was only launched last year though, and it is in this platform that contractors have the potential to secure that single version of the truth based on real-time data. But time cards are only one element of connecting people—field productivity solutions like Assignar, Raken or Struxi. Other vendors like Kojo are taking purchasing and inventory visibility to new, AI-driven heights. Multiple GPS-enabled fleet management software vendors do a solid job with equipment, often integrating this data stream with various other equipment- and project-related business processes. Companies like Latium Technologies seem to have a similar vision and product in market, but lack the resources and ability to deliver an scale that the T3 team with EquipmentShare can lay claim to. The T3 team alone is many times the size of Latium's entire complement of employees. Contractors evaluating T3 should push hard for insights on a roadmap a year or more out, and perhaps try to influence the direction of the product, pushing Schlacks and his team towards an even stronger market position for connected construction operations.