Founded in 2013, Pronovos Construction Intelligence has built a cloud-based business intelligence tool for both general contractors and subcontractors that solves unique problems for each. And ts cloud-agnostic architecture is something that should be the envy of many operations software companies as it supports multi-cloud deployment—something desirable for mission-critical software.

When I debriefed Pronovos CEO Bruce Orr in February of this year, his company employed 20, most of them developers or data scientists, and six customer-facing sales and customer success professionals. Orr, however, said the company tends to orient data scientists by sending them into the field to work with customers to provide them with insight and context for the work they will be doing.

Orr said he boostrapped the company, with no external capital.

Construction Operations and Analytics Software

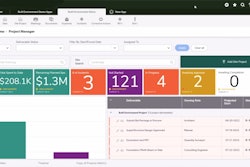

Pronovos offers both an enterprise-wide application for project management and analytics offerings for the front office.

Pronovos Operations Manager includes:

Office and field communication to track projects as they progress

Field reporting including photos and project updates

Resource visibility of equipment and manpower

Document management

Pronovos Analytics includes:

No-code tools to create interactive dashboards

Project profitability analysis

Collaboration tools to provide financial and schedule visibility to project teams

Dashboards for work-in-progress, revenue projections, accounts payable and accounts receivable

More than a visual dashboard though, Pronovos packs some serious artificial intelligence horsepower, particularly for estimators.

“We are doing some AI for estimating,” Orr said. “We have made a portion of our software that’s flexible enough so estimators can do perimeter positions, form types, whatever attributes you have to look at for labor, materials and subcontractors.”

But the goal, according to Orr, is to go beyond single-project analytics, which the software handles looking both forward and backwards. Rather, ProNovos is also a tool for rolling projects into an enterprise view that helps chart a path for an organization. ProNovos is designed to give both executives and frontline workers data insights that support decisions—cash flow projections, labor demand given project requirements and churn, project portfolio analyses, projects with the most near misses, most likely to run over due to lack of crew or frequent revisions.

ProNovos delivers capabilities, required by some project owners, for earned value management (EVM). Here we see Budgeted Cost of Work Performed (BCWP) plotted against budged cost of work scheduled (BCWS).

Analytics for Subcontractors

ProNovos has worked primarily for large generals that had the resources to pay not just for the technology, but for ProNovos’ expertise. But in late 2021, the company began focusing on productizing and packaging products to a greater extent than before, making it easier to sell value while reducing professional services cost. This puts advanced technology within reach of smaller organizations.

In the fourth quarter of 2021, the company released to market tools for subcontractors. Subcontractors are, for instance, often required by general contractors to use Procore for project reporting. Using a new tool from Procore, they can capture their data for later analysis in ProNovos.

“My family’s background is in subcontracting,” Orr said. “So I have an affinity to help subs because they carry a lot of risk related to labor. We’re providing the same tech that general contractors spent a ton of money for and making it affordable for subs. We just needed to minimize the need for professional services with prepopulated content.”

The solution has grown powerful capabilities in analysis of labor hours, which can fluctuate based on varying numbers of hours tasks take, the extent to which overtime is required, varying union pay rates, bottlenecks caused by a general contractor and other factors that may not be adequately expressed in the estimate. This makes estimate at completion (EAC) and estimate to completion (ETC) essential calculations to perform throughout the project, but difficult for many subcontractors or even generals to perform in an intuitive way.

“EAC and ETC—every time a contractor sits down to do this calculation, and there is often a variance—to do better or worse than you thought. When you generate a variance, we are quickly asking for a reason for that variance. The product offers a stock of selections contractors can choose form. But once we start understanding the variances and the conditions where those variances occur, we can start predicting why a variance may come up and the reason for the variance.”

This can help the contractor with their own estimating or decision support on projects, but can also provide context for a general or a project owner when explaining the variance.

“When you generate a variance, you typically have to report to someone,” Orr said. “Pronovos lets you provide an answer—going back to AI—so you know the answers, can tell them there will be a variance and provide reasons and a mitigation strategy for the variance.”

Without an application like this, contractors are limited to looking at historical performance and conjecture.

“We look at equipment, materials, subcontractors and other large categories,” Orr said. “Generals that don’t self perform do not worry much about labor. They are not the ones paying a premium because the general contractor didn’t do what they need to do contractually, forcing you to move your schedule and pay people time and a half.”

Tech Stack

Pronovos has the most advanced tech stack I have seen, due in part to their cloud-agnostic, multi-cloud approach. Being an analytics shop, they build a lot of technology in Python, Apache Kafka for data streaming, all commonly used tools for multitenant software as a service (SaaS) software Like ProNovos.

Depending on whether the application is dealing with structured or unstructured data, ProNovos is provisioned in either Amazon Web Services or the Microsoft Azure Cloud with failover capabilities from one to the other. AWS in particular has been hit by high-profile outages and in these cases, damaging a software vendor’s customer experience.

The company’s continuing investment in AI will deliver increasing returns in the coming years.

“Real life application of machine learning in construction is an uphill battle,” Orr said. “We have piloted some projects that focused on getting better at estimating on public projects. Data is available to everyone. If you are a bridge contractor and are bidding in particular regions, there are not a lot of players bidding, maybe five to 10. We were able to get the data from the government website, pull the data into our model, determine who is going to bid, what they will be bidding and what the winning bid is going to be. With AI, we are more concerned with contractors awarded projects can ensure the margins they build into their project going to make are being made. Our is AI focused on final cost module.”

Apart from the integration with Procore aimed at subcontractors, ProNovos has packaged integrations with Autodesk Construction Cloud, and works plug-and-play with Acumatica by integrating with their assortment of application programming interfaces (APIs). For historically on-premise software, they have developed an applet that integrates the software with a customers’ Sage 100, Sage 300 and Computerease accounts, driving batch updates typically every 15 minutes. ProNovos has partnered with Foundation Software to create an automated integration as well.

Who is ProNovos For?

The addressable market has increased substantially since ProNovos has been productizing and packaging its offering, and adding tools aimed at subcontractors. Their sweet spot is probably subcontractors and any company that self performs including general contractors that self perform. In early 2021 the targeted contractor size was around $100 million and up. But with a more standardized, prepopulated analytics tool, ProNovos is now within reach of contractors with as little as $10 million in contract value.

Price

ProNovos sells individual seat subscriptions, with different pricing for trade contractors versus generals. At the bottom end, a subscription can cost about $5,000. There is no start-up cost, but there is an annual contract. Orr said that if customers are not happy with the product, they have not been enforcing the contract, just issuing a refund for the balance of the term.

BOTTOM LINE: So what’s my bottom line on ProNovos? I am bullish on their growth, not only because of the product, but because the company is now setting up reseller and referral relationships with certified public accounting and other consultants, which can be a force multiplier to help them scale past venture-funded rival, Briq. Since Pronovos is bootstrapped, they may be in a position to grow organically on their own longer, while a venture-funded company may be steered towards building towards some type of acquisition or other liquidity event. They are also in the early stages of transforming into a company with standard products as opposed to a tool set company that performs consulting and systems integration. Orr said his goal is to be on 80 percent of job sites within five years, and while this is ambitious, I would not be inclined to bet against him.