Pleasanton, Cal.-based California Engineering Contractors (CEC) works on some of the most impactful infrastructure projects in the region, including bridge restoration, demolition and replacement and highway paving.

“We take on the most challenging projects,” California Engineering Contractors (CEC) President Wahid Tadros said. “They built a new bridge over the bay here, and we took down the old one, about a two-mile bridge over the water. We just retrofitted a rapid transit tube under San Francisco Bay. We're retrofitting the gates for a dam up in Folsom, Cal., to allow them to add three feet of water to the dam. They want to raise the lake elevation and the gates have to be made stronger so they can take the extra pressure from the water.”

CEC executes some hard bid work and some construction manager general contractor (CMGC) agreements to marry a plan with construction means and methods with a negotiated price. This problem-solving approach is a fit for CEC as according to Tadros, almost every employee has an engineering degree.

“Some are professional engineers, and some have their masters” Tadros said “We are not doing any engineering design. We're primarily contractors. The reason the name of the company is California Engineering Contractors is a lot of the work we do requires construction engineering, which is different than design engineering. We have to design temporary works to assist us in getting the project complete.”

A Civil Construction Software Stack

Executing complex projects in a heavily regulated environment is not easy, and to keep things under control CEC relies on its system of record, Sage 100 Contractor, which is integrated with HCSS Heavy Job for project costing. The company uses B2W, now part of Trimble, for estimating.

But Tadros also worked closely with Planera on development of a schedule risk analysis tool, and in December of 2023 Planera announced the company was using the new capability. They had at that point been a Planera customer for about a year, according to Tadros.

“I think, Planera is a breath of fresh air,” Tadros said. “I mean, we're getting tools that are much more usable, which allows more people to use them, which then allows us to harness the thought processes, the intelligence and the experience of a lot more people. Now, almost everyone who works here can make a schedule on Planera.”

This extends the planning capacity substantially given that only two CEC employees were competent in Oracle P6, which had been used previously. Planera is one of a number of construction-focused planning and scheduling tools coming to market that through specialization can streamline planning processes for construction users. Elecosoft, for instance, also offers Monte Carlo simulation, and competes with general project management software like P6 and Microsoft Project. Some smaller or middle market contractors in particular may find these advanced tools used in major project management offices may be overkill for their needs.

“People that never made schedules—that always just sat with the scheduler and told them what they thought it should be and had the scheduler make schedules—are now making schedules themselves and presenting those schedules,” Tadros said.

As a sophisticated multi-tenant software-as-a-service (SaaS) application, Planera supports record sharing so more than one CEC employee can work on the same schedule simultaneously. Planera has also eliminated non-value-added work.

“With my estimators making their own schedules, they don't have to take the job, describe it to a scheduler who then creates a basic schedule that they then review and optimize it to show management at bid review session,” Tadros said. “Now, it's coming directly from the estimators. And it's much easier to see and understand.”

CEC’s instance of Planera is not integrated with its other construction software solutions as of yet according to Tadros, but they have a strong interest in seeing an integration with HCSS Heavy Job.

“They do our labor tracking and cost tracking,” Tadros said. “And I understand they're talking to HCSS about integration.”

Construction Risk Simulation Software

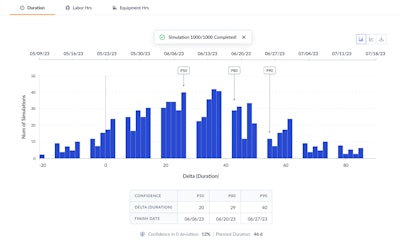

Risk identification and mitigation in construction is an important discipline given the number of interdependencies between schedule risks, resource constraints and exposure to cost fluctuations. Monte Carlo analysis helps a construction management team identify the potential outcomes of decisions and then identify the likelihood of each will occur by running thousands of simulated projects. Software can then help monetize that risk for decision support. Tadros, whose father founded CEC, says risk management is essential for contracting businesses like his to survive from one generation to the next.

“Construction is probably one of the biggest turnover businesses in the world in terms of the amount of contractors that come in and out of the business, because for one reason or another, they don't make it,” Tadros said. “I think one of the most important things that we do, as contractors to stay in the long term is risk management, and risk analysis. We're constantly evaluating risks, and trying to make sure we don't fall in the hole, basically. Risk management up until now, especially from a scheduled point of view, probably in a lot of ways, has been very subjective. We write a list, we make a risk register, and we write down all the risks that we foresee in a project, both schedule risks and cost risks. We assign probabilities to those risks, and then from those probabilities we assigned dollars, but it's all a very subjective kind of process. And what this risk analysis tool does for us is it makes it objective. We can put in parameters of what the risks can be, the downside and the upside. And then by running the simulations, the product is is able to give us a quantitative answer as to the value of the risk, rather than just a subjective answer.”

AI-driven business guidance is not worth much unless it is actively used in decision support, and CEC is already using the insights to day-to-day.

“When we go to build a job, we enter these criteria and run the simulations, and then get an idea of what the risk is of the job running over time and what the potential benefit is, and then based on that, we assign a dollar amount to it,” Tadros said.

This dollar amount can be accounted for in the cost estimate, but has also helped CEC walk away from projects where the juice may not have been worth the squeeze.

“We've had projects that we would not bid just because it was a no-go,” Tadros said. “The risk was too high. Our visibility into go-no-to factors is greatly improved. I would say that most contractors go out of business from taking on too much work, not from not having enough work. The job we don't get or the job we don't take is the best job we never got, as we would look at it.”