Based in Holmdel, N.J., Workwave is a field service management software company that has grown by acquisition, and has a laser-like focus on the small to medium business (SMB) market. Having gained a broad spectrum of functionality though these acquisitions, Workwave has built an architecture that packages these capabilities to contractors sending technicians or crews to multiple sites in single day.

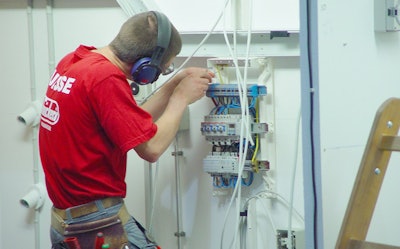

Who needs field service management software? Typically, we are talking about contractors involved in heating, ventilation, air conditioning and refrigeration (HVACR), landscaping, electrical and other construction disciplines. As more contractors get involved in selling high-margin maintenance contracts and project warranties, the ability to profitably price and deliver service while ensuring a quality customer experience becomes a mission critical discipline.

Uniting multiple field service softwares

Enterprise software companies that grow by acquisition can struggle to present a unified customer experience because the multiple products they market have different interfaces and different master data structures. Even when various products in a portfolio are targeted at different markets or user bases, as is the case with some of the WorkWave products, the software vendor must also invest in developing and evolving multiple code lines and infrastructures.

In this area, WorkWave had some heavy lifting to do because their acquisitions included:

- Viamente in 2012 for route planning and optimization

- ContactUs.com in 2015, bringing in a contact form builder and lead management tools for websites

- GPS Heroes in 2016 augmented the portfolio with GPS monitoring to track and manage vehicle fleets, including geofences, idling events, maintenance alerts

- Servman in for 2018 field service management with scheduling, dispatching, job costing, accounting, work orders and quotes management, route optimization, contract and warranty management

- Real Green Systems in 2021 added broad enterprise software for contracting businesses, focused on landscaping, pest control and HVACR

- TEAM Software in 2021 Cloud-based ERP and workforce management for contractors with accounting, financials, operations, analytics, HR, payroll, time and attendance, bidding, estimating and compliance

- Slingshot in 2021 for sales and call center support

This pattern of acquisitions has given WorkWave a broad product set, and also helped them swell their ranks to 1,200 employees, including about 75 in sales and another 75 in customer success. But the company is not content to sit on the combined install base of its acquisitions, and is bringing new customers into the fold, adding new products and rationalizing its acquired products into a coherent suite in a responsible and rigorous fashion. All of this lead to 195 percent year-over-year revenue growth in the first quarter of 2022 versus 2021.

Maximizing field service resources

WorkWave is one of a number of software products aimed at the SMB space that take a broad view of the needs of an entrepreneurial contracting business.

“We are looking at helping them leverage their labor force,” Workwave COO Tim Robinson said. “We give them CRM and ERP solutions, but also helping them recruit talent, retain talent and operate more efficiently. That includes scheduling, routing, helping them leverage our scale, helping them become more efficient at maximizing their cash flow with payment and financial solutions. We regularly ask our customers where they think we should be adding more value.”

The marketing services group does more than help contractor customers build pipeline—WorkWave also harnesses their capabilities to help customers recruit staff in a tight labor market.

“We are trying to help getting talent in the door,” Workwave Vice President of Product Rick Agajanian said. “We have a marketing services group that knows how to write content, do SEO, execute paid strategies and perform other talent management work. Today, you have to position your business so people want to go work for you. We have an applicant tracking solution (ATS) that sits underneath that.”

These areas of added value from Workwave include a digital marketing services function that helps customers with everything from custom websites, search engine optimization (SEO) and email templates to offline advertising and media. In April of 2022, the company also launched WorkWave Financial Services, a collection of financial offerings including low-interest credit cards. This service offering augments an integrated payments platform, launched in 2019, that delivers level 1 compliance with the Payment Card Industry Data Security Standard (PCI DSS). Also in 2021 WorkWave launched mobile terminal payments so contractors can increase cash flow by enabling customers to pay at time of service using a mobile point-of-sale device that is fully integrated with their back end software.

“The people who use our software in a lot of the industries we work with are front-line workers themselves,” Agagananian said. “They don’t know the technology pieces out there. About 70% prefer to use one solution rather than having to plug solutions into other stuff to market themselves.”

“We are also selling some financial products through in-app purchases,” Robinson said. “We have a business builder card our customers can buy into, designed for smaller customers to help them establish credit and distinguish business from personal credit. We are exploring a similar offering for insurance, too.”

WorkWave is not just banking on these value added services. They deliver software highly optimized for construction contractors delivering field service.

“Our software consists of multiple products, all focused around a customer being able to manage the business, jobs, completion of tasks, financial aspects,” Agajanian said. “The trend across all industries is towards the labor side, and we pay close attention to maximizing the amount of efficiency we can help our customers gain, with tools we can provide to help them manage that labor force, vehicles and licenses.”

WorkWave starts addressing the field service value chain from the beginning—at the proposal. They deliver a platform for full visibility of proposals, so contractors can fully understand and quantify work that is being bid. Later the contractor can analyze accuracy of the scopes in these proposals based on actual performance against the contract while providing metrics for performance against efficiency targets. Multiple business functions from routing, contract management and customer relationship management (CRM) are all aligned in the WorkWave product suite.

An Evolving Product and Tech Stack

Workwave is not the only software vendor to grow by acquisition, and other software vendors serving the industry have purchased multiple legacy on-premise software products and are taking various routes to evolve them into well-rationalized products on more modern architectures. Command-Alkon for instance replaced a broad spectrum of acquired products with Connex, their multi-tenant application for the ready-mix concrete, asphalt and aggregate sectors, including dynamic scheduling. Trimble is working to unite their disparate acquired construction software products by standardizing the underlying data structures so business processes can more gracefully flow from one to the next within the Trimble Construction One suite. Autodesk, like Command-Alkon, boiled down their acquired applications and replaced them with Autodesk Construction Cloud.

In the case of WorkWave, Agajanian’s team seems to be doing an intelligent job of turning a collection of applications, some home grown, some acquired, some multi-tenant SaaS and some historically on-premise products, and offering them up as a coherent product line connected by a micro-services architecture.

“A number of our solutions have been in the market for a while, and are some underway to be modernized,” Agajanian said. “They are all cloud based—you can access all of them in the cloud. There are some legacy customers that have not transitioned yet. Every new customer that comes on board is offered cloud as an option. There are not many times we would offer an on-premise solution for any verticals we are in.”

Intelligently, WorkWave leads with its most fully-realized SaaS product in SMB-sized companies like lawn care and landscaping. Multi-tenant SaaS is often the single best delivery method for SMB software.

“Our most modern is a product called Workwave Service, which is for smaller sized companies. It is a lot of tools for managing your customers—the CRM, task management,” Agajanian said. “Another more modern one is a product called Route Manager, and there are a lot of companies in construction or an adjacent space that use this. Route Manager is used for scheduling routes, pickups and deliveries. We can sell Route Manager individually, but it is plugged into scheduling tech used in other vertical for field service like mechanicals.”

This approach to microservices architecture, where a software company exposes narrow slices of functionality in one product that can be consumed by others in the portfolio, is smart and in keeping with where software for the enterprise level is headed.

With a more complex organization like an HVACR contractor executing on annual maintenance agreements would probably lead with a more mature and functionally deep product, Servman.

“Servman has been in the market for a while, has long term customers, and is a sticky software platform due to high level of configurability which the customer base loves,” Agajanian said. “This product is used heavily by HVAC, plumbing, contractors.”

While some of the technology underpinning WorkWave products may be more mature, net new functionality is being built with the REACT open source library for the front and relies on a SQL database running in an single tenancy to ensure data security. The different methods used to build the new functionality versus the legacy functionality in Servman just means that, while the new software is still configurable, that configuration tool will feel more modern and rely on check boxes to turn things on and off. The older version is a little more sophisticated in terms of how you can adjust things on the fly.”

WorkWave is continually extending and evolving Servman and other products in the portfolio with a microservices architecture that puts a common set of functionality that cuts across industries. Servman will consume these microservices to deliver a modern approach for these broad processes managing leads, reporting, and payments. The core industry-focused functionality for CRM, financials, scheduling and workforce management are part of the mature and proven solution. WorkWave has constructed an abstraction layer that data from these microservices will pass through to help normalize and it and conform it to the needs of the various industry solutions. Individual pages and functionality within the legacy ServMan solution are still updated as required, but the process is not as fast or graceful as would be the case with more current tech underpinnings.

“What we are really focused on is how do we help the team members in the field be more efficient and effective,” Robinson said. “But then we also hear the technicians need a more modern interface because of how they interact with their phones personally. We are really focused on that because it is an employee retention concern and then working our way to the back office.”

Pricing and market

WorkWave is one of a number of field service management software providers that serves the SMBs, in contrast to others, like sister company IFS, that target enterprise-level field service fleets with hundreds or thousands of technicians. EQT had been bundled in with IFS by private equity owners, but split off in June of 2021 due in part to the diverse markets.

WorkWave has a large addressable market and best-in-class functionality that has been, for its targeted industries, hard for competitors to match. They have struggled more with the look and feel of the legacy parts of their product set, which means contractors more interested in horsepower than the paint job may prefer WorkWave.

“The great thing WorkWave has done is accumulated functionality for pest control, lawn care, cleaning janitorial, security contractors and HVAC functionality that makes up a robust solution. In sales cycles, we are not running into missing functionality,” Agagananian said.

The strong functional set, offered at a reasonable price point and downscalable to the smallest entrepreneurial contractor makes WorkWave a desirable partner for companies on a recurring revenue model like annual service or maintenance contracts and companies that want to master their scheduling and cash flow. HVACR contractors, security equipment companies, landscaping and snow removal, materials testing contractors and others visiting multiple sites per day and need to optimize and track these tasks and provide proof of service. Crews performing extensive day-long or multi-day project tasks on a single site are a poor fit for WorkWave or, really any field service management software application. Larger companies with very large field service workforces, reverse logistics requirements or deep inventory control needs also may be a better fit for WorkWave’s sister company, IFS and its field service management product.

For most of its modules, WorkWave prices primarily on a per-user model, but can break down users by back office license users and mobile users, which are sold at a lower price point than those using the full administrative capabilities. Other modules are sold on a flat fee per month. Larger customers with about 500 licenses or more can negotiate enterprise pricing.

BOTTOM LINE: Contracting by nature can create lumpy revenue as projects are sold, billed and closed out. Recurring revenue from maintenance contracts and project warranties should be of intense interest to HVACR, landscaping, roofing, glazing, security and other types of specialty contractor. There is a broad spectrum of products designed to help contractors profitably sell and manage these profitable contracts, and some are more willing to serve construction and the SMB space. If you are an SMB contractor who values not just streamline technology that enables profitable service delivery but also the backing of a technology team dedicated to your business success, selecting an appropriate product for WorkWave may be a solid move.