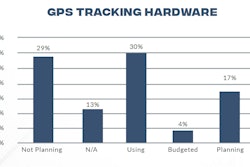

In the IRONPROS and FORCONSTRUCTIONPROS 2023 State of the Industry Construction Technology Report, GPS-Tracking Hardware came out as the technology the most respondents were either currently using or planning/budgeting for. Devices that track location and operational metrics from equipment come from a variety of different companies, many of which also have construction asset management software to expose the equipment data to operational processes inside a construction business.

HCSS is one of these companies, and its Equipment 360 and HCSS Telematics products are widely used among heavy and civil contractors. So it may have seemed odd for some in the industry to see HCSS’s March 21 announcement of a partnership with Clue Insights, which to outward appearances would seem a direct competitor. Contractors can choose from a number of software applications and products from vendors whose rhetoric may sound similar to what we see on Clue’s website—“Maximize productivity. Minimize Downtime. Your entire fleet on one platform.” One thing that distinguishes Los Angeles-based Clue from the field is their lack of hardware—they have no sensor or telematics hardware, either their own or white labeled, to sell or install.

Our IRONPROS product discovery call with Clue Insights C-Founder and CEO Oded Ran revealed some secret sauce, though, that could drive more partnerships with more GPS Asset Tracking and Fleet Management software companies. And what is that secret sauce?

Connect, Scrub, Clean, Harmonize Disparate Data

Succinctly—most large contractors have multiple asset tracking systems, and Clue Insights’ applications can access, clean, harmonize and standardize the data for enterprise-wide decision support and process automation. Clue also integrates with multiple enterprise resource planning software products ranging from construction applications like Viewpoint to products from SAP and Oracle. So Clue Insights becomes more of a cross-application management and orchestration engine. While it has its own unique functionality, Ran suggested the real value to customers comes from enhanced ability to use data they have already collected in multiple connected fleet management software products.

“Any company thinking that AEMP is a standard, well, it’s a standard that’s not standard,” Ran said. “You may find one brand of dump truck has a problem with a given version of the AEMP standard. So part of our day-to day-job is maintenance of these data pipes we know very well. If we are talking to a company with 20 assets, they don’t get this. But that contractor with 1,000 assets—they feel the pain.”

No Hardware Barriers

Ran describes the company, which employs 24 including two focused on net new sales, as being product-lead—driven by customer needs and requirements. Lacking hardware and installation teams, this small complement can support very large customers that few asset tracking hardware/software combinations could handle from an installation standpoint. Different use cases for different classes of equipment can also lead to contractors running multiple connected asset management tools. Within a multi-division construction environment, various requirements may lead to the selection of multiple hardware and software vendors ranging from Tenna, Azuga, Fleetio, Rooster Asset Tracking, DPL Telematics, Geotab, Samsara and others. Some may lean more on hardware while others are primarily software vendors that may white label hardware from others. While modern software should support integration through application programming interfaces (APIs), these IoT devices installed on equipment also are sometimes specific to the software vendor, which contributes to silos and system fragmentation.

“There are all of these hardware providers,” Ran said. “For just software—we are the only software in the space. We got started four years ago and have been working with very large contractors. Most of these companies already have solutions in place for on road, offroad equipment and other assets, and these systems are not connected. We are not in that market with Geotab, Samsara and others. But we do connect with every one of these platforms, and contractors come to us—including the Top 25 like Kiewit and Skanska. Of course, they have various solutions, but even though they have these systems, they have not been able to measure uptime, prove utilization, reduce rentals or achieve other goals. It all feels disconnected.”

Upstream and Downstream Integrations

Apart from asset management software used for on-road and offroad fleets, Clue also has integrations in place with enterprise resource planning (ERP) products. This includes broad tier 1 products from SAP and Oracle, but also construction ERP products like Coins, Foundation and those from Trimble like Viewpoint Vista and Spectrum. Due to the varied implementations and configurations even among contractors running same ERP product, these integrations are often created for a specific customer rather than standardized.

“We announced our partnership with HCSS this week,” Ran said. “The challenge we are solving is that you have a customer that already has HCSS, maybe running Heavy Job or Equipment 360. But they may use a different telematics provider. That means they don’t have everything on one pane of glass.”

Clue can be the presentation layer that provides a comprehensive view across applications, but it can also perform transactional functions.

“Maybe you need to reconcile budgeted hours versus actual hours for equipment,” Ran said. “It is difficult if you have 800 assets all in different platforms. Clue can reconcile them.”

Clue will unite not just individual connected asset management tools but also put that data into a broader enterprise context through integrations with back-office systems like ERP. In essence, Clue has its own functional offerings for asset management, but could also come to serve as a middleware or integration platform for construction asset software. This in turn enables an executive and management team to make better decisions about assets to maximize return based on more timely data with fewer manual steps that consume time and create the opportunity for errors.

“One problem is when you have a mechanic working on equipment who cannot see the service history,” Ran said. “Or perhaps you have a piece of equipment you might be selling but can’t see that you have just replaced the tires. What was your uptime last year? What was your average number of breakages? It is right now painful for companies to even know—what was your uptime last year when equipment was on site. What percentage of the time was it available? This is where we play.”

Enabling Proactive Asset Management

The Clue application goes to market in three modules or functional areas, including:

- Integrate—View your fleet on a single pane of glass, sourced from multiple connected asset management products and telematics, including utilization reporting, daily visual inspection reports (DVIRs) and digital time sheets.

- Automate—Real-time visibility comes through a dashboard with production KPIs including tonnage, volume, operating time, load counts, cycle time, swing time, CO2 emissions and more while texts and alerts notify users of maters that require attention.

- Optimize—Here, Clue delivers something akin to corporate performance management, enabling an executive team to manage to key performance indicators (KPIs). This can include financial or non-financial KPIs like those some contractors and construction entities must track when it comes to carbon emissions. Ran demonstrated at CONEXPO-CON/AGG 2023 a use case for carbon emission reporting that accounts for different fuel types, regional differences like those for California, kWh of power used, number of assets using gas or diesel vs electricity and other impacts like oil in water.

Clue Tech Stack

Clue is a multi-tenant software-as-a-service (SaaS) application that runs on Amazon Web Services (AWS). The application relies on a modern, serverless architecture, which delegates management of cloud compute resources to AWS. This lowers cost because compute resources are made available as needed which reduces spending on unused compute capacity. Serverless architecture also speeds time to market for new innovations because software designers do not need to spend time thinking about or ensuring the serviceability of the underlying operating environment.

Mobile applications for Android and iOS are built using React Native, which among other benefits enables push notifications to users to download new versions.

Pricing and Market

Clue is priced based on a combination of fleet size and the modules a customer uses.

When it coms to which contractors will find the best fit with Clue, a lot of it has to do with the number and complexity of assets they are operating. A contractor with 500 assets may feel al the pain points that makes Clue desirable but Ran said that an organization with 10 assets may find value if those assets are very expensive, complex or mission critical. Ran stresses the technology, as it currently exists, is a fit for heavy and civil contractors but less so for utilities, underground contractors and others.

BOTTOM LINE: Clue Insights is a reminder of one simple fact in construction technology—more and more, walls are out, and wheels are in. Proprietary barriers that may have been designed to create a moat around a product offering have created demand for applications that can do an end-run around those barriers. That is exactly what Clue does, while also reconciling the multiple data structures and field definitions and conventions of diverse software systems into a coherent whole. Rather than competing for more of the customer wallet by notching out other products, Clue Insights helps contractors get more value from the money they are already paying to their existing vendors. Combined with the company’s customer-lead approach, it is a strategy the philosopher Lao Tzu may recognize.

"Why is the sea king of a hundred streams? Because it lies below them. Therefore, it is the king of a hundred streams. If the sage would guide the people, he must serve with humility. If he would lead them, he must follow behind.”

-Lao Tzu